More than 70% of U.S. bank accounts are set up to receive instant payments. Your customers are already enjoying the convenience of consumer-to-consumer apps like Apple Pay, Venmo, Zelle and more. They expect the same speed and efficiency in their business transactions. You’ll meet those expectations easily and affordably with Paycision.

By harnessing the power of instant payments at scale, Paycision lets you:

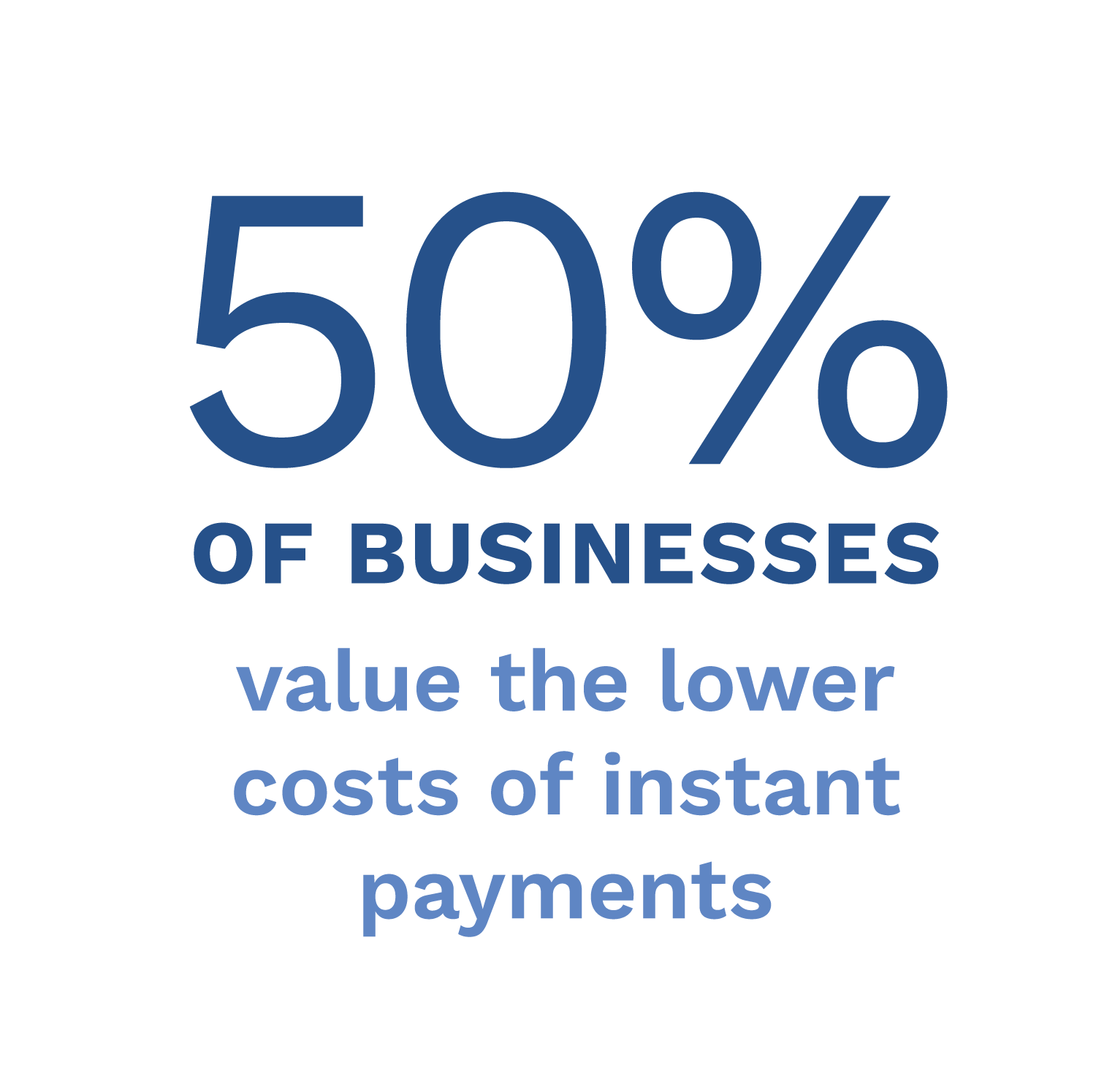

- Replace expensive card and wire-based payments

- Negotiate better supplier terms by paying instantly or just in time

- Reduce your cost of funds by paying off loans early or drawing funds upon payment

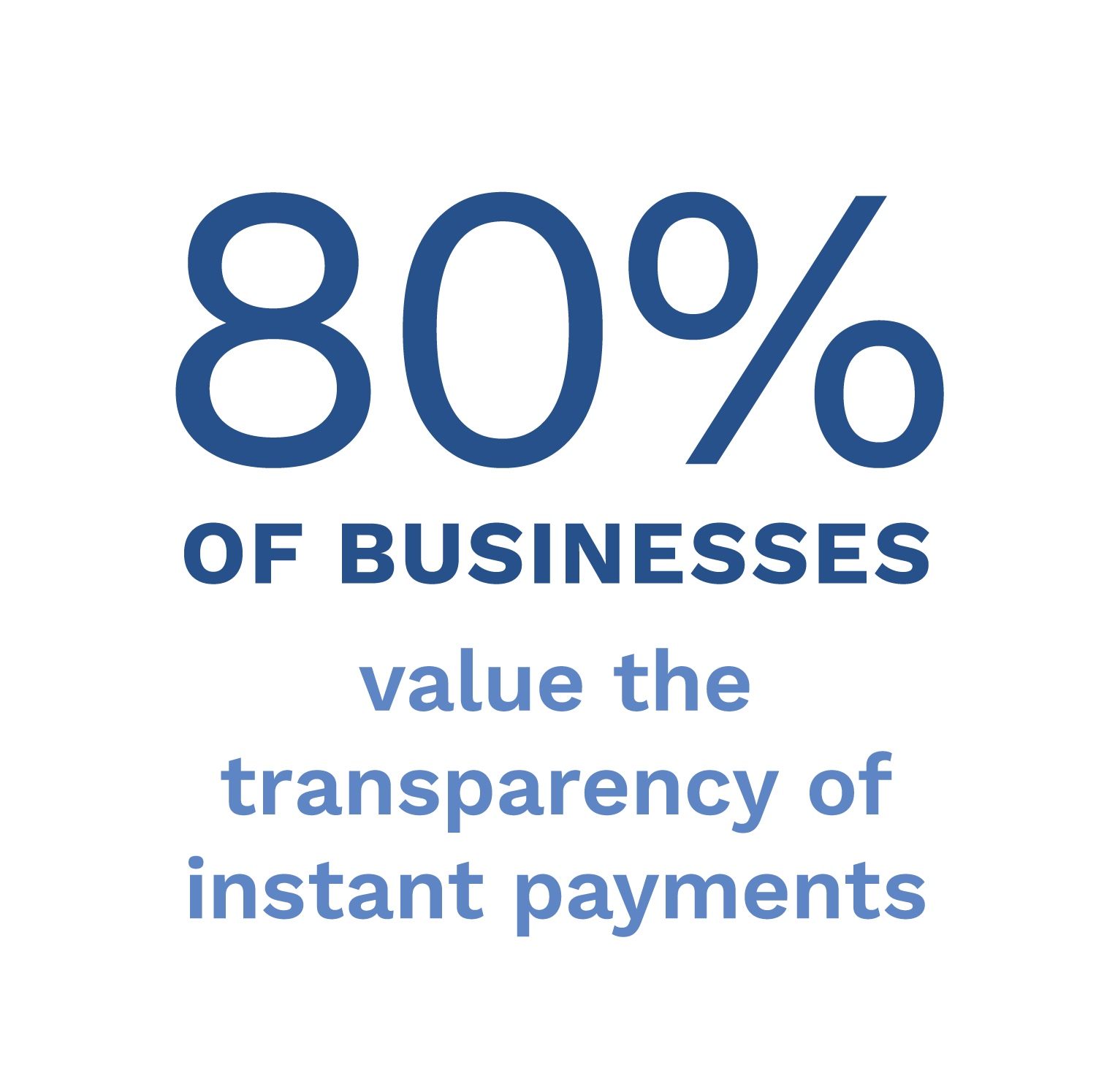

- Create happier partners with payments that are easy to reconcile

- Streamline your finance function by processing more payments straight through

Paycision advantages

- HOSTED SAAS SOLUTION—no software to buy, install or manage

- MULTIPLE PAYMENT CHANNELS (RTP, FedNow, ACH, check)

- FRAUD MITIGATION that adapts and responds to your changing business without compromising security

- SMART ROUTING across payment types and networks

- ROBUST APIS that make it easy to embed payments in your applications

- SMOOTH INTEGRATION with multiple banking relationships and accounts

- SEAMLESS INTERFACE TO THIRD-PARTY DATA like bank statements, customer records and enterprise resource planning data

- FLEXIBLE CONNECTIVITY with real-time or batch interfaces

- AUTOMATIC ADOPTION of network updates

- COMPREHENSIVE APPROVAL WORKFLOWS based on roles and permissions

- INTUITIVE REPORTING MODULE that connects the dots for quick and easy reconciliation

- SUPPORT FOR VALUE-ADDED TRANSACTIONS, including request for payment and account validation